Your Leggett and platt dividend safety images are available in this site. Leggett and platt dividend safety are a topic that is being searched for and liked by netizens today. You can Get the Leggett and platt dividend safety files here. Find and Download all royalty-free images.

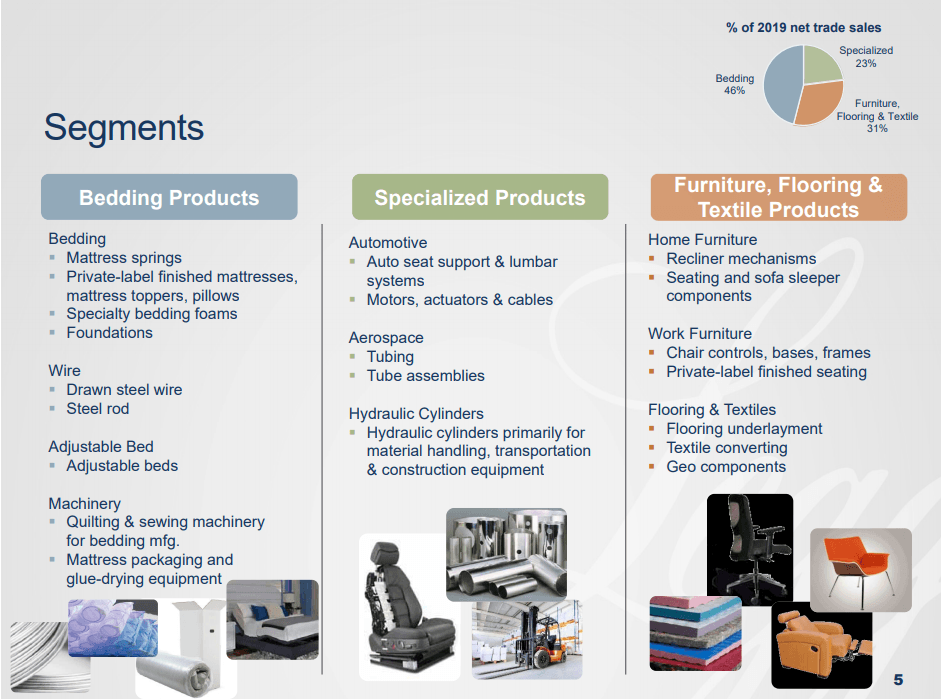

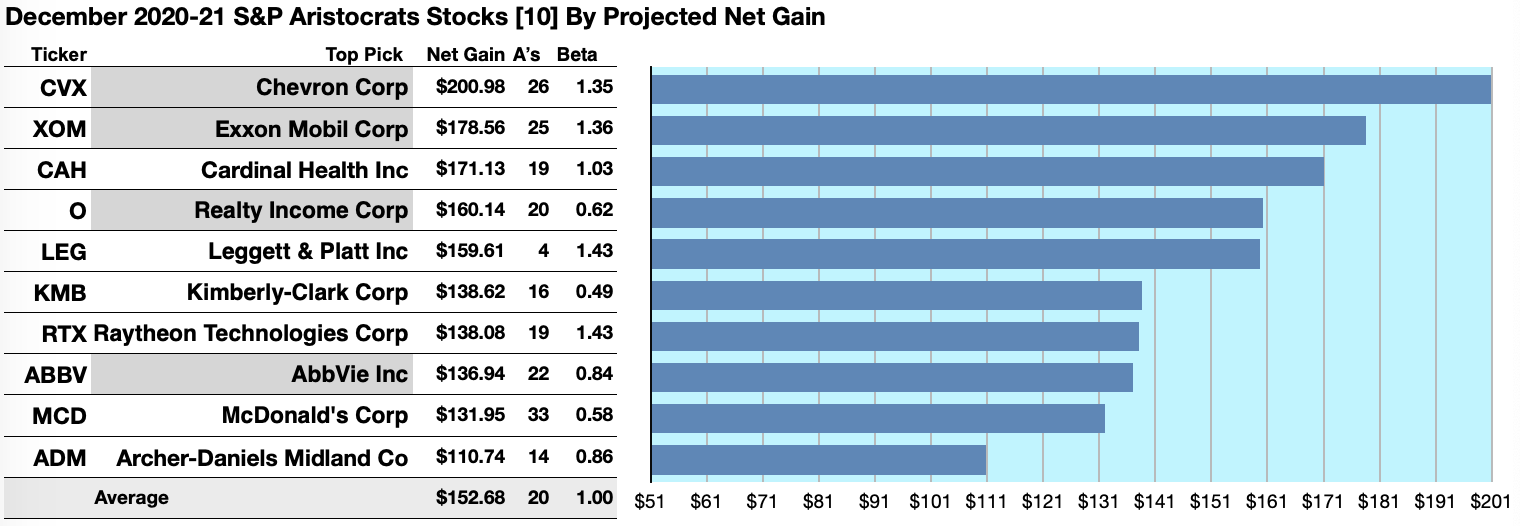

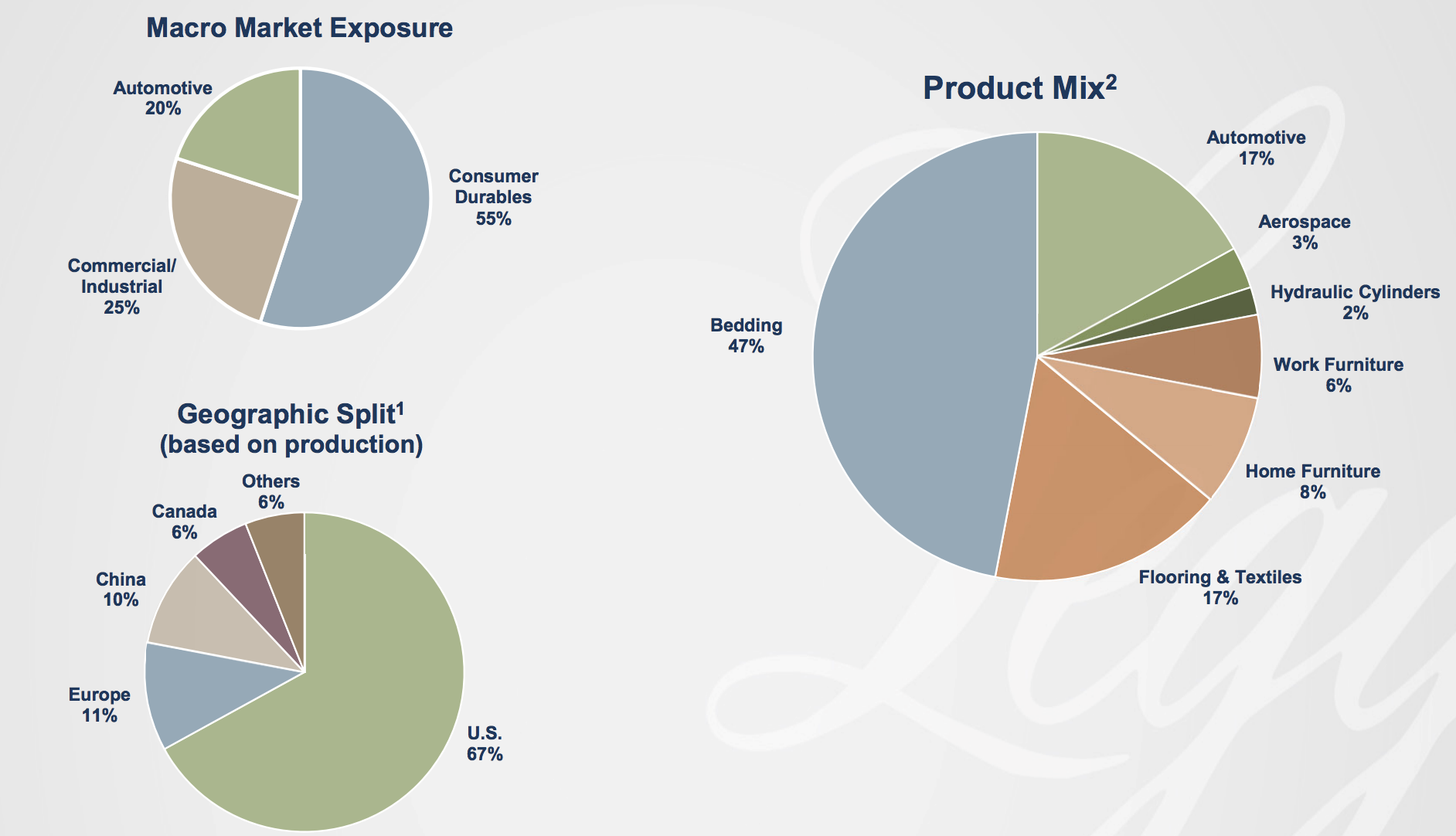

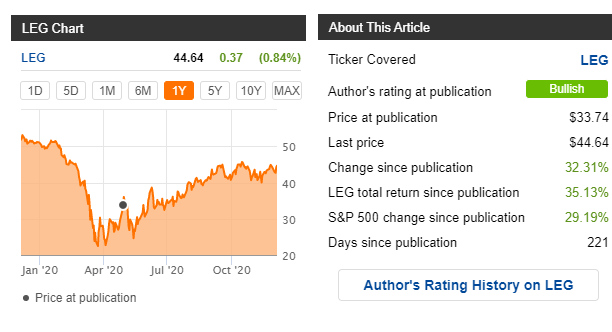

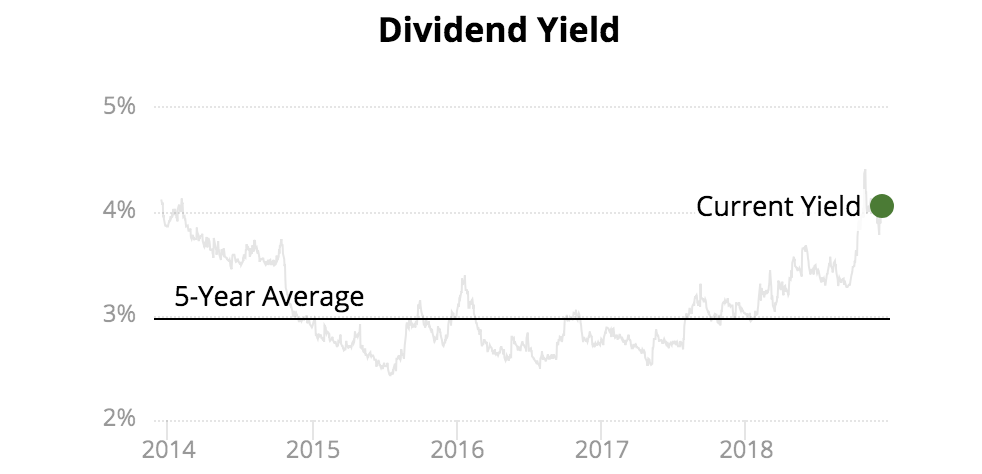

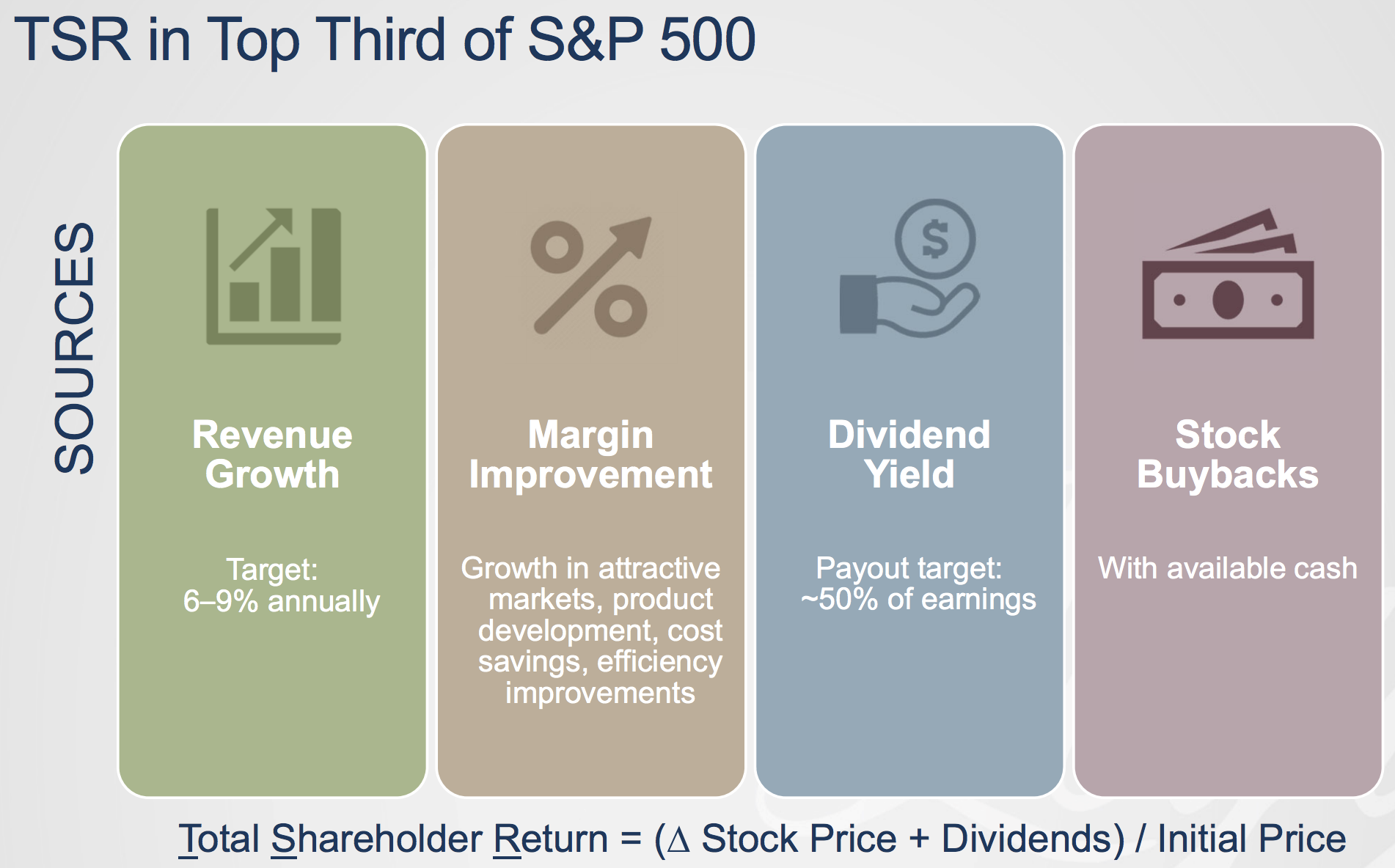

Leggett And Platt Dividend Safety. Leggett Platt conceives designs and produces a diverse array of products that can be found in most homes offices and vehicles. The dividend yield however is the true attraction. Leggett Platt is a diversified industrial company which has raised its dividend for 47 consecutive years making it a dividend aristocrat and poised to soon become a dividend king. Second quarter dividend was 40.

Leggett Platt Announces 3q 2020 Earnings Call Dividend Stocks Dividend Common Stock From pinterest.com

Leggett Platt Announces 3q 2020 Earnings Call Dividend Stocks Dividend Common Stock From pinterest.com

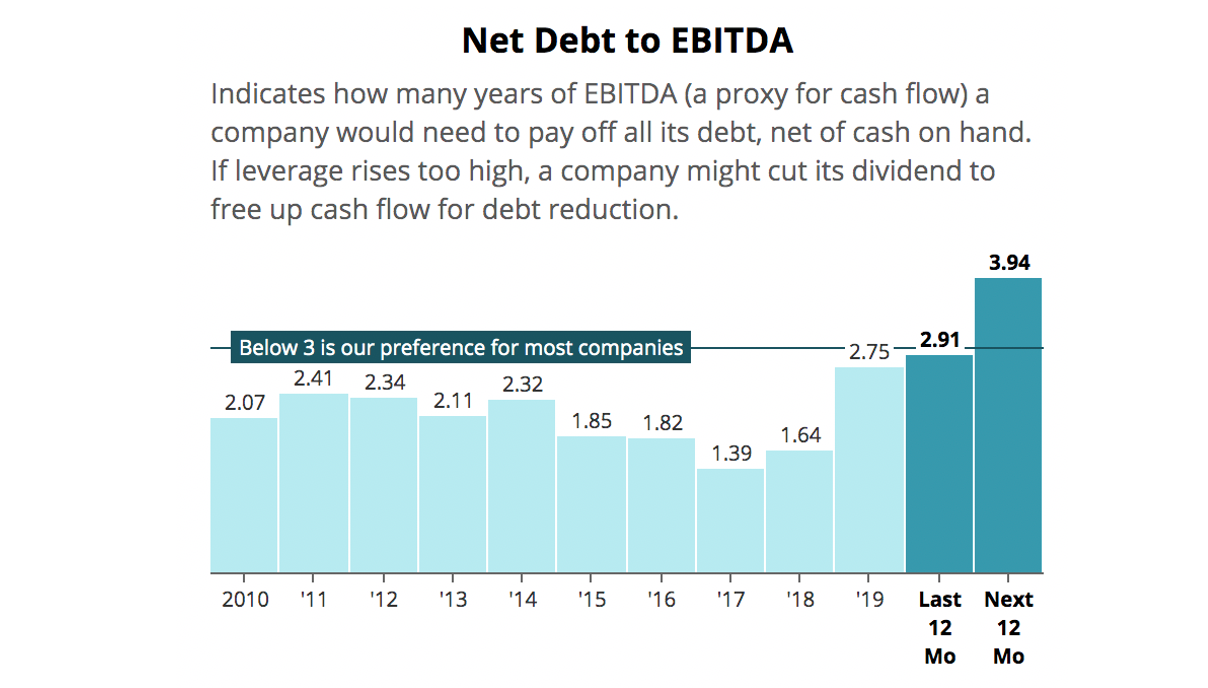

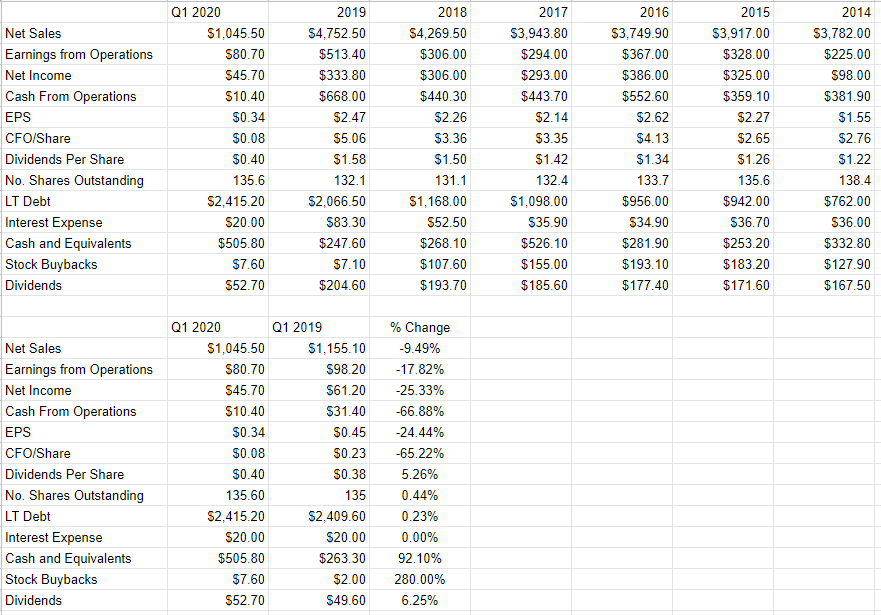

Investors should complete comprehensive due diligence before investing. Business Analysis Leggett Platts impressive dividend growth track is fueled by the firms long-standing customer relationships the company has been in the industry for over 100 years economies of scale the firm is also vertically integrated. Expected Record and Payment Dates for 2020. Simply Safe Dividends If nothing has changed with a companys long-term prospects or dividend safety a relatively high yield can be a signal that a business is attractively priced. Based on the Dividend Discount Model Leggett and Platt would have to boost its dividend growth rate to 6 or 65 per year in order to justify the current stock price of a bit under 32 assuming a 10 discount rate. Leggett Platt.

At this point Leggett Platt is doing all the right things and has a sustainable dividend.

F grade indicates serious dividend safety risks. Leggett Platt LEG suspends its guidance and temporarily closes some of its facilities in response to the impact of COVID-19 pandemic. APR 07 0300 PM EDT 4651 017 037 LEG. Expected Record and Payment Dates for 2020. 3Q sales were 1208 billion down 3 vs 3Q19. Leggett Platt pays out 6226 of its earnings out as a dividend.

Source: seekingalpha.com

Source: seekingalpha.com

F grade indicates serious dividend safety risks. Its positive to see that Leggett Platts dividend is covered by both profits and cash flow since this is generally a sign that the dividend is sustainable and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut. Investors should expect another dividend increase in mid. The Leggett. LEGs next quarterly dividend payment will be made to shareholders of record on Thursday April 15.

Source: uk.pinterest.com

Source: uk.pinterest.com

LEGs next quarterly dividend payment will be made to shareholders of record on Thursday April 15. Leggett Platt LEG suspends its guidance and temporarily closes some of its facilities in response to the impact of COVID-19 pandemic. Leggett Platts situation is a little more complicated due to the 125 billion acquisition of Elite Comfort Solutions management announced last month. Board declared fourth quarter dividend of 40 per share. Leggett Platt has 14 business units and more than 22000 employees.

Source: dividendstocks.cash

Source: dividendstocks.cash

Leggett Platt LEG suspends its guidance and temporarily closes some of its facilities in response to the impact of COVID-19 pandemic. Leggett Platt conceives designs and produces a diverse array of products that can be found in most homes offices and vehicles. Simply Safe Dividends If nothing has changed with a companys long-term prospects or dividend safety a relatively high yield can be a signal that a business is attractively priced. Many investors look at the payout ratio to determine dividend safety. Leggett Platt was founded in 1883 and is headquartered in Carthage MO.

Source: pinterest.com

Source: pinterest.com

The companys steady dividend growth in a sector known for its volatile sales and earnings is. Leggett Platt LEG suspends its guidance and temporarily closes some of its facilities in response to the impact of COVID-19 pandemic. 3Q adjusted 2 EPS was a record 1 80 up 04 vs 3Q19 adjusted 2 EPS. Diversified manufacturer Leggett Platt reported a. Leggett Platts situation is a little more complicated due to the 125 billion acquisition of Elite Comfort Solutions management announced last month.

Source: seekingalpha.com

Source: seekingalpha.com

3Q sales were 1208 billion down 3 vs 3Q19. If the stability of the business is considered and a 9 discount rate is allowed then the required dividend growth rate falls. LEGs next quarterly dividend payment will be made to shareholders of record on Thursday April 15. Leggett Platt reported its second quarter earnings results on August 3. Leggett Platt LEG suspends its guidance and temporarily closes some of its facilities in response to the impact of COVID-19 pandemic.

Source: seekingalpha.com

Source: seekingalpha.com

NYSE Stock Leggett Platt Dividend policy. Qualifying the company as a Dividend Aristocrat and Dividend Champion. APR 07 0300 PM EDT 4651 017 037 LEG. F grade indicates serious dividend safety risks. Leggett Platt Dividend.

Source: seekingalpha.com

Source: seekingalpha.com

So a payout ratio of 60 would mean that every 1 Leggett Platt earns it pays investors 060. Investors should expect another dividend increase in mid. Leggett Platt which pioneered sleep technology when it introduced its bedspring more than 125 years ago is an SP 500 diversified manufacturer serving a broad suite of customers that comprise a Whos Who of US. Many analysts believe that comparing a companys dividend payments to its free cash flow is a better method for assessing dividend. Leggett Platt has 14 business units and more than 22000 employees.

Source: in.pinterest.com

Source: in.pinterest.com

Leggett Platt reported its second quarter earnings results on August 3. Second quarter dividend was 40. Leggett Platt Dividend. The companys steady dividend growth in a sector known for its volatile sales and earnings is. We possess one of the best dividend growth records among the SP 500.

Source: simplysafedividends.com

Source: simplysafedividends.com

Many analysts believe that comparing a companys dividend payments to its free cash flow is a better method for assessing dividend. Our focus remains on the health and safety of our employees and their. Leggetts dividends have increased each year for the last 48 consecutive years 1971 - 2019. Second quarter dividend was 40. If the stability of the business is considered and a 9 discount rate is allowed then the required dividend growth rate falls.

Source: seekingalpha.com

Source: seekingalpha.com

Diversified manufacturer Leggett Platt reported a. Its positive to see that Leggett Platts dividend is covered by both profits and cash flow since this is generally a sign that the dividend is sustainable and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut. Leggett Platt Dividend. Leggett Platt is a dividend aristocrat and has increased its dividend for 48 consecutive years. Many investors look at the payout ratio to determine dividend safety.

Source: seekingalpha.com

Source: seekingalpha.com

Leggett Platt is a dividend aristocrat and has increased its dividend for 48 consecutive years. If the stability of the business is considered and a 9 discount rate is allowed then the required dividend growth rate falls. Expected Record and Payment Dates for 2020. The dividend yield however is the true attraction. Leggett Platt.

Source: pinterest.com

Source: pinterest.com

Its positive to see that Leggett Platts dividend is covered by both profits and cash flow since this is generally a sign that the dividend is sustainable and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut. Leggett Platt. Diversified manufacturer Leggett Platt reported a. The Leggett. Leggett Platt Dividend.

Source: in.pinterest.com

Source: in.pinterest.com

Leggett Platt pays out 6226 of its earnings out as a dividend. At this point Leggett Platt is doing all the right things and has a sustainable dividend. We possess one of the best dividend growth records among the SP 500. If the stability of the business is considered and a 9 discount rate is allowed then the required dividend growth rate falls. Safe for dividend investors.

Source: simplysafedividends.com

Source: simplysafedividends.com

The dividend yield however is the true attraction. LEGs next quarterly dividend payment will be made to shareholders of record on Thursday April 15. APR 07 0300 PM EDT 4651 017 037 LEG. Leggett Platts situation is a little more complicated due to the 125 billion acquisition of Elite Comfort Solutions management announced last month. Leggett Platt Dividend policy No Change Price as of.

Source: in.pinterest.com

Source: in.pinterest.com

Leggett Platt. The Leggett. Leggett Platt is a dividend aristocrat and has increased its dividend for 48 consecutive years. Leggett Platt Incorporated LEG Dividend Safety metrics. Leggetts dividends have increased each year for the last 48 consecutive years 1971 - 2019.

Source: 1.simplysafedividends.com

Source: 1.simplysafedividends.com

F grade indicates serious dividend safety risks. Many analysts believe that comparing a companys dividend payments to its free cash flow is a better method for assessing dividend. Leggett Platt conceives designs and produces a diverse array of products that can be found in most homes offices and vehicles. Leggett Platt has 14 business units and more than 22000 employees. 3Q cash flow from operations was a record 261 million.

Source: seekingalpha.com

Source: seekingalpha.com

They look at the dividend per share divided by the net income per share. Based on the Dividend Discount Model Leggett and Platt would have to boost its dividend growth rate to 6 or 65 per year in order to justify the current stock price of a bit under 32 assuming a 10 discount rate. Investors should expect another dividend increase in mid. LEGs next quarterly dividend payment will be made to shareholders of record on Thursday April 15. Payout ratio calculation and chart.

Source: seekingalpha.com

Source: seekingalpha.com

3Q sales were 1208 billion down 3 vs 3Q19. Leggetts dividends have increased each year for the last 48 consecutive years 1971 - 2019. Simply Safe Dividends If nothing has changed with a companys long-term prospects or dividend safety a relatively high yield can be a signal that a business is attractively priced. Leggett Platt Incorporated LEG Dividend Safety metrics. They look at the dividend per share divided by the net income per share.

Source: dividendgrowthinvestor.com

Source: dividendgrowthinvestor.com

LEGs next quarterly dividend payment will be made to shareholders of record on Thursday April 15. If the stability of the business is considered and a 9 discount rate is allowed then the required dividend growth rate falls. Simply Safe Dividends If nothing has changed with a companys long-term prospects or dividend safety a relatively high yield can be a signal that a business is attractively priced. Leggett Platt Dividend. Qualifying the company as a Dividend Aristocrat and Dividend Champion.

Source: simplysafedividends.com

Source: simplysafedividends.com

Leggett Platt which pioneered sleep technology when it introduced its bedspring more than 125 years ago is an SP 500 diversified manufacturer serving a broad suite of customers that comprise a Whos Who of US. Many analysts believe that comparing a companys dividend payments to its free cash flow is a better method for assessing dividend. In this video we perform a deep dive on Leggett Platts dividend safetyLeggett Platt is a well-known dividend stock because of its compelling track rec. Expected Record and Payment Dates for 2020. 3Q sales were 1208 billion down 3 vs 3Q19.

Source: simplysafedividends.com

Source: simplysafedividends.com

Leggett Platt Dividend policy No Change Price as of. 2 2020 PRNewswire – 3Q EPS was a record 1 77 an increase of 03 vs 3Q19. Qualifying the company as a Dividend Aristocrat and Dividend Champion. F grade indicates serious dividend safety risks. Investors should expect another dividend increase in mid.

Source: m.youtube.com

Source: m.youtube.com

The dividend yield however is the true attraction. Board declared fourth quarter dividend of 40 per share. If the stability of the business is considered and a 9 discount rate is allowed then the required dividend growth rate falls. In this video we perform a deep dive on Leggett Platts dividend safetyLeggett Platt is a well-known dividend stock because of its compelling track rec. Many analysts believe that comparing a companys dividend payments to its free cash flow is a better method for assessing dividend.

Source: pinterest.com

Source: pinterest.com

The companys steady dividend growth in a sector known for its volatile sales and earnings is. Diversified manufacturer Leggett Platt reported a. 3Q cash flow from operations was a record 261 million. LEGs next quarterly dividend payment will be made to shareholders of record on Thursday April 15. Leggett Platt has 14 business units and more than 22000 employees.

Source: pinterest.com

Source: pinterest.com

Many investors look at the payout ratio to determine dividend safety. Leggett Platt conceives designs and produces a diverse array of products that can be found in most homes offices and vehicles. At this point Leggett Platt is doing all the right things and has a sustainable dividend. LEGs next quarterly dividend payment will be made to shareholders of record on Thursday April 15. 3Q cash flow from operations was a record 261 million.

Source: 1.simplysafedividends.com

Source: 1.simplysafedividends.com

Leggett Platt conceives designs and produces a diverse array of products that can be found in most homes offices and vehicles. Leggett Platt. So a payout ratio of 60 would mean that every 1 Leggett Platt earns it pays investors 060. Diversified manufacturer Leggett Platt reported a. APR 07 0300 PM EDT 4651 017 037 LEG.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title leggett and platt dividend safety by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.