Your Leggett and platt dividend cut images are ready. Leggett and platt dividend cut are a topic that is being searched for and liked by netizens now. You can Get the Leggett and platt dividend cut files here. Find and Download all free vectors.

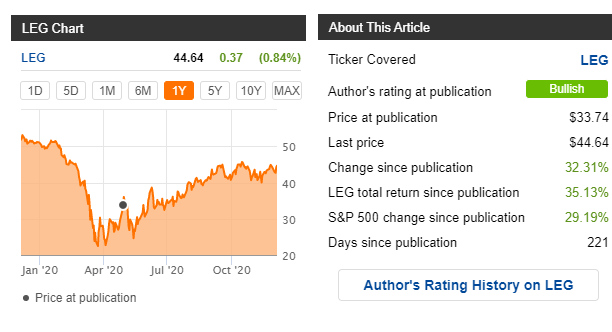

Leggett And Platt Dividend Cut. The previous Leggett Platt Inc. Leggett Platt LEG will raise its quarterly dividend to 36 cents per share in 2018. Thomas Grotzer was named interim head of complianceThe bank cut its dividend proposal for 2020 to 10 centimes a share from about 29 centimes and suspended its. On May 7 2019 Leggett Platts board of directors declared a 040 quarterly dividend per share.

Leggett Platt A Hold Able Cyclical Dividend Stock Nyse Leg Seeking Alpha From seekingalpha.com

Leggett Platt A Hold Able Cyclical Dividend Stock Nyse Leg Seeking Alpha From seekingalpha.com

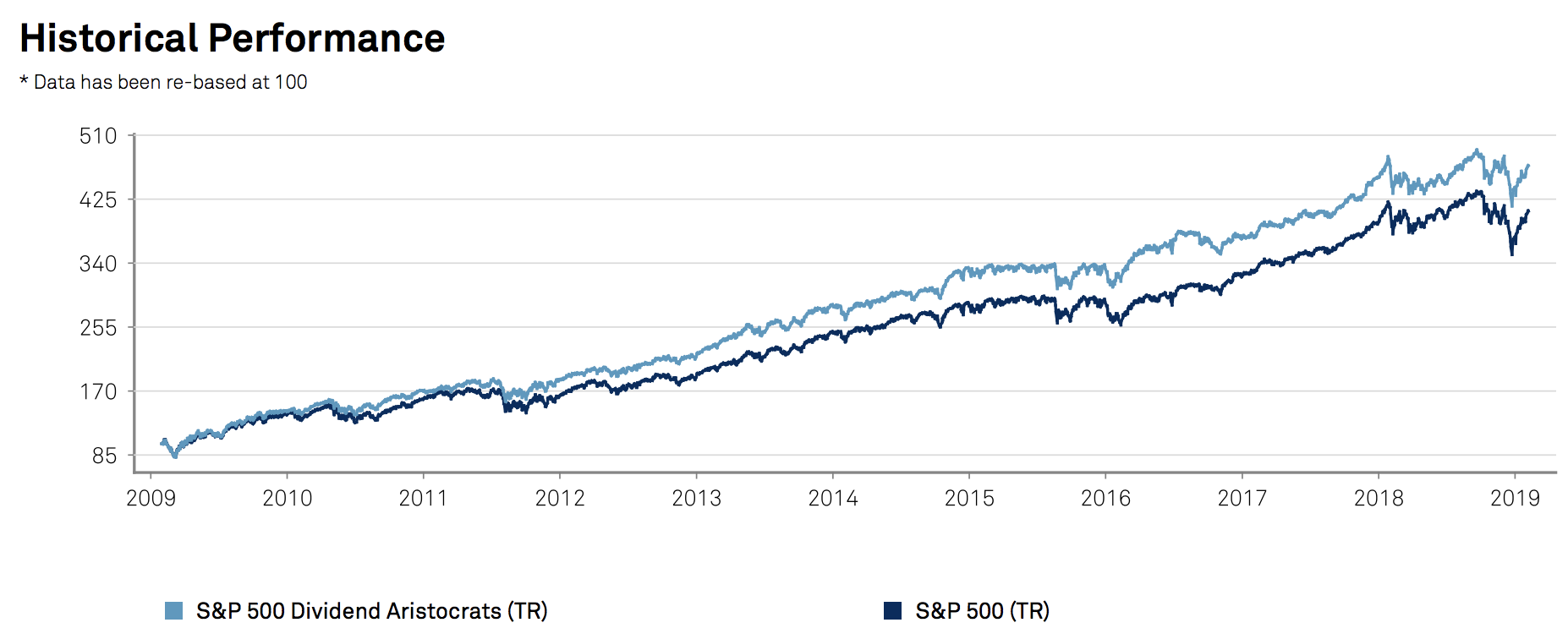

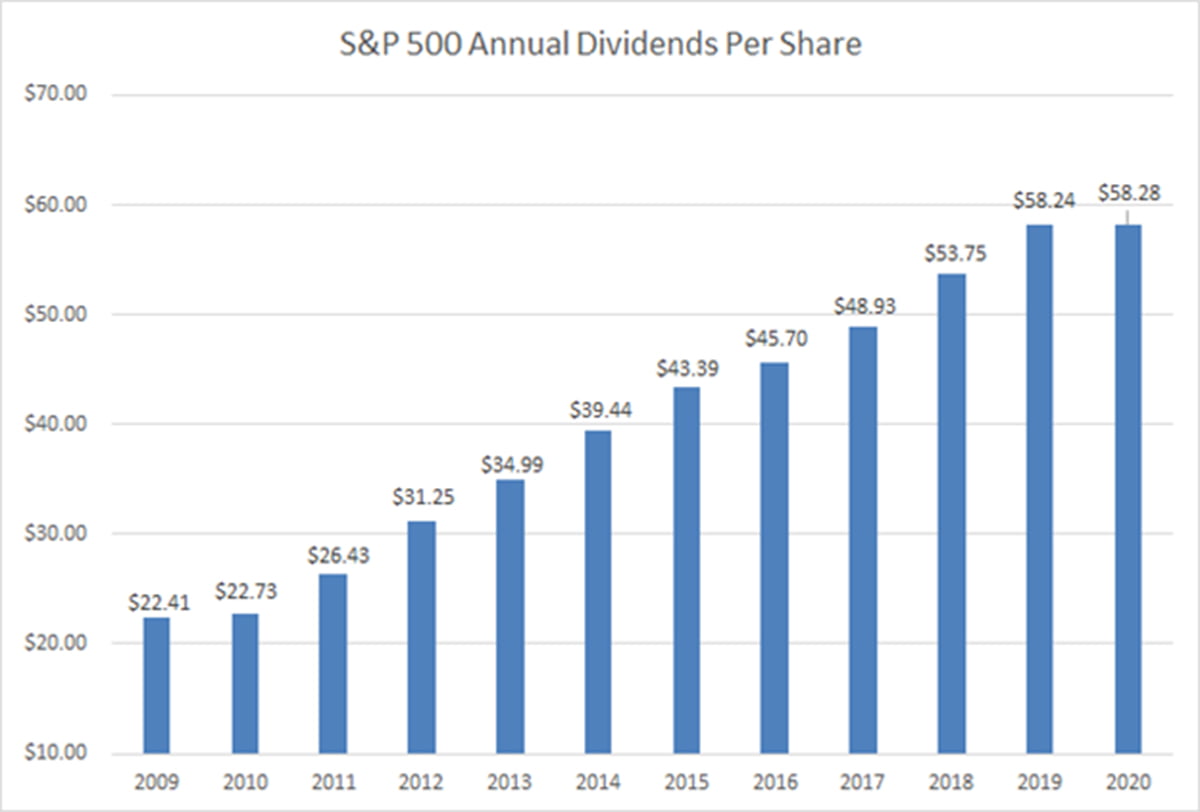

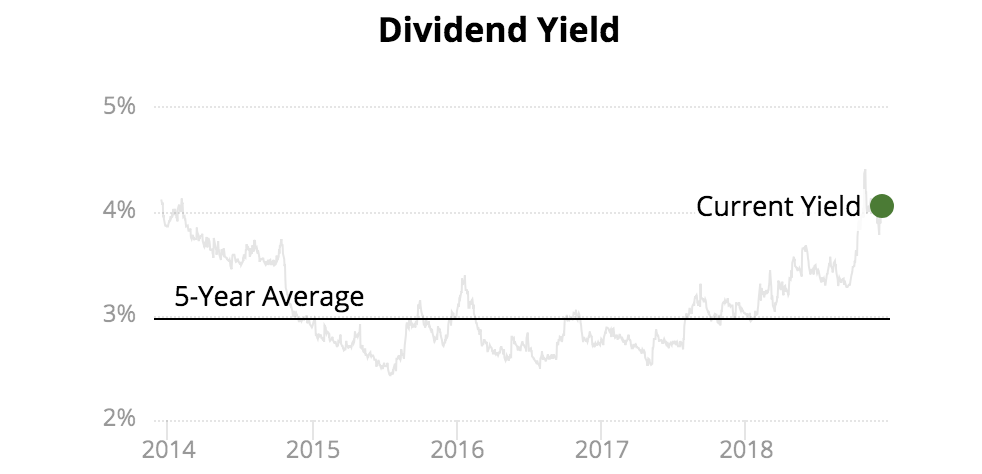

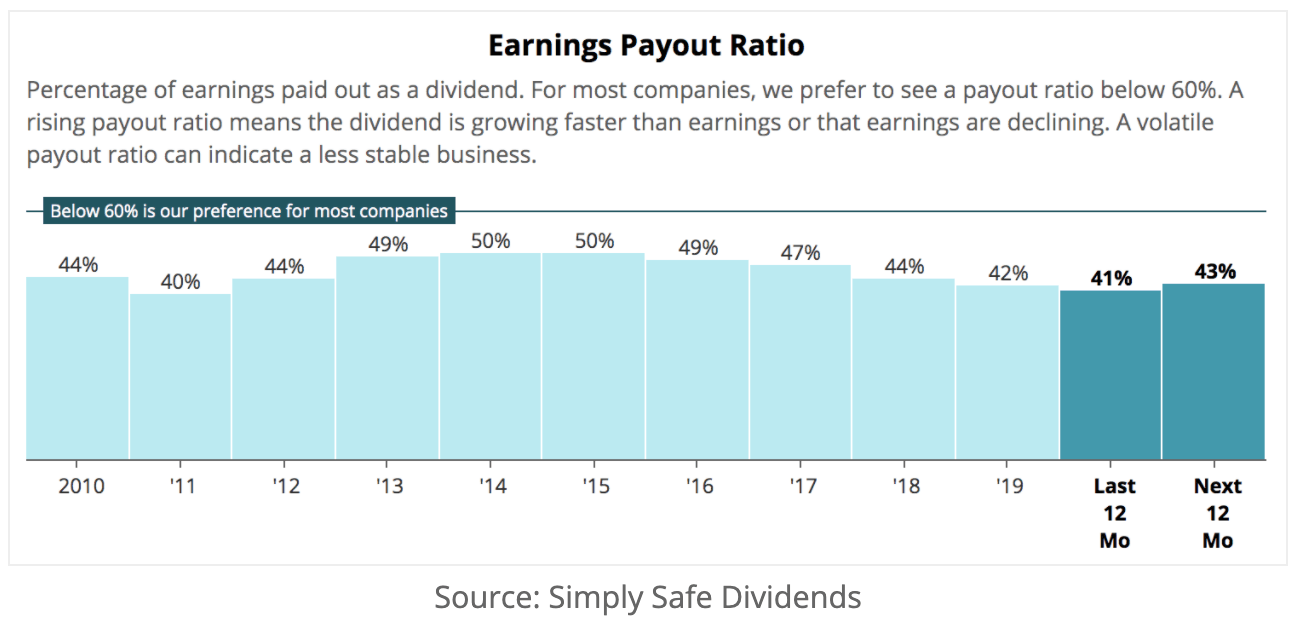

Shouldnt you want a company that dont slash its dividends in bad times. We possess one of the best dividend growth records among the SP 500. Leggett Platt Dividend. This marks the 47th consecutive year of dividend increases by the Dividend Aristocrat. Its positive to see that Leggett Platts dividend is covered by both profits and cash flow since this is generally a sign that the dividend is sustainable and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut. LEG didnt cut its dividend in 2009.

Payment and record dates are the 15th or the last business day preceding the 15th if the 15th falls on a Saturday Sunday or Holiday.

Using earnings Leggett Platts dividend appears very. Using earnings Leggett Platts dividend appears very. Leggett Platt is a diversified industrial company which has raised its dividend for 47 consecutive years making it a dividend aristocrat and poised to soon become a dividend king. Dividend was 40c and it went ex 4 months ago and it was paid 3 months ago. Leggett Platt LEG will raise its quarterly dividend to 36 cents per share in 2018. We possess one of the best dividend growth records among the SP 500.

Source: seekingalpha.com

Source: seekingalpha.com

Cutting your dividend in half to only double it means youre back to 2009 level. A stocks dividend reliability is determined by a healthy payout ratio that is higher than other stocks. Leggett Platt LEG will raise its quarterly dividend to 36 cents per share in 2018. Its positive to see that Leggett Platts dividend is covered by both profits and cash flow since this is generally a sign that the dividend is sustainable and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut. For context Leggett Platt currently pays a quarterly dividend of 038 per share for a payout ratio of 57 in the most recent quarter.

Source: seekingalpha.com

Source: seekingalpha.com

The Leggett. Thus Leggett Platt is a dividend aristocrat that has increased the dividend every year for more than 25 years. High dividend yields usually over 10 should be considered extremely risky while low dividend yields 1 or less are simply not very beneficial to long-term investors. Leggett Platts dividend payout ratio DPR is presently 6226. The previous Leggett Platt Inc.

Source: newacademyoffinance.com

Source: newacademyoffinance.com

The dividend is payable July 15 to shareholders of record by the close of business on. The companys steady dividend growth in a sector known for its volatile sales and. Shouldnt you want a company that dont slash its dividends in bad times. The company qualifies for the Dividend Aristocrats Index as it has 47 years of consecutive dividend increases. Leggett Platt paid out a conservative 39 of its free cash flow as dividends last year.

Source: pinterest.com

Source: pinterest.com

This marks the 47th consecutive year of dividend increases by the Dividend Aristocrat. Thomas Grotzer was named interim head of complianceThe bank cut its dividend proposal for 2020 to 10 centimes a share from about 29 centimes and suspended its. That is an impressive figure. Less nice is the partly quite high payout ratio. For context Leggett Platt currently pays a quarterly dividend of 038 per share for a payout ratio of 57 in the most recent quarter.

Source: nextlevel.finance

Source: nextlevel.finance

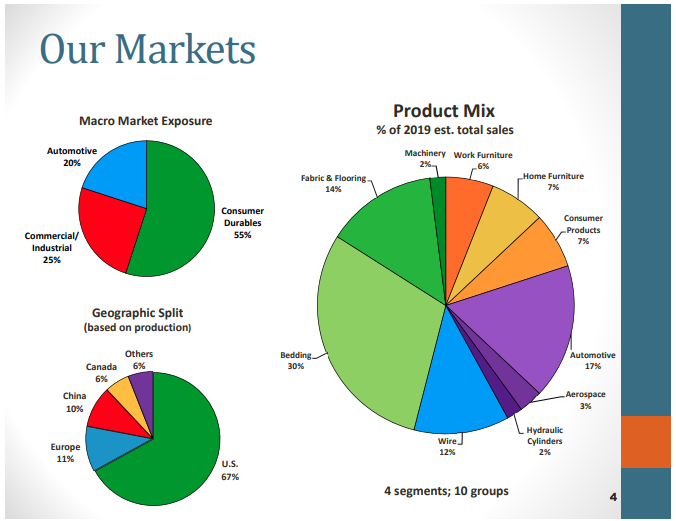

Leggett Platt is a diversified industrial company which has raised its dividend for 47 consecutive years making it a dividend aristocrat and poised to soon become a dividend king. Leggett Platt has 14 business units and more than 22000 employees. Its positive to see that Leggett Platts dividend is covered by both profits and cash flow since this is generally a sign that the dividend is sustainable and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut. With a 31 dividend yield Leggett Platt pays its shareholders a bit more than one-and-a-half times the market average. Wood sold 10346 shares of the businesss stock in a transaction dated Thursday February.

Source: in.pinterest.com

Source: in.pinterest.com

The dividend is payable July 15 to shareholders of record by the close of business on. With a 31 dividend yield Leggett Platt pays its shareholders a bit more than one-and-a-half times the market average. We possess one of the best dividend growth records among the SP 500. The Leggett. Leggett Platt reported its second quarter earnings results on August 3.

Dividend was 40c and it went ex 4 months ago and it was paid 3 months ago. The company has increased its dividend for 49 years. In other Leggett Platt news Director Phoebe A. The new dividend represents a 53 increase from the prior dividend of 038. The companys steady dividend growth in a sector known for its volatile sales and.

Leggett Platt is a diversified industrial company which has raised its dividend for 47 consecutive years making it a dividend aristocrat and poised to soon become a dividend king. Leggett Platts Board of Directors announced a dividend of 40 per share for the second quarter equal to the dividend declared in the second quarter of 2019. Leggett Platt LEG will raise its quarterly dividend to 36 cents per share in 2018. Leggett Platts dividend payout ratio DPR is presently 6226. Using earnings Leggett Platts dividend appears very.

Source: in.pinterest.com

Source: in.pinterest.com

Thus Leggett Platt is a dividend aristocrat that has increased the dividend every year for more than 25 years. That is an impressive figure. The companys steady dividend growth in a sector known for its volatile sales and. For context Leggett Platt currently pays a quarterly dividend of 038 per share for a payout ratio of 57 in the most recent quarter. Less nice is the partly quite high payout ratio.

Source: seekingalpha.com

Source: seekingalpha.com

Leggett Platt Stock Drops 10 on Weak Earnings Dividend Cut Worries Sales have fallen by nearly half under the COVID-19 shutdown and the bedding and flooring company may have to. The dividend is payable July 15 to shareholders of record by the close of business on. The company qualifies for the Dividend Aristocrats Index as it has 47 years of consecutive dividend increases. There are typically 4 dividends per year excluding specials and the dividend cover is approximately 16. That is an impressive figure.

Source: seekingalpha.com

Source: seekingalpha.com

Its positive to see that Leggett Platts dividend is covered by both profits and cash flow since this is generally a sign that the dividend is sustainable and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut. The previous Leggett Platt Inc. We possess one of the best dividend growth records among the SP 500. The company qualifies for the Dividend Aristocrats Index as it has 47 years of consecutive dividend increases. This marks the 47th consecutive year of dividend increases by the Dividend Aristocrat.

Source: seekingalpha.com

Source: seekingalpha.com

In other Leggett Platt news Director Phoebe A. Cutting your dividend in half to only double it means youre back to 2009 level. LEG didnt cut its dividend in 2009. The dividend is payable July 15 to shareholders of record by the close of business on. Thomas Grotzer was named interim head of complianceThe bank cut its dividend proposal for 2020 to 10 centimes a share from about 29 centimes and suspended its.

The new dividend represents a 53 increase from the prior dividend of 038. Leggett Platt LEG will raise its quarterly dividend to 36 cents per share in 2018. Dividend went ex 23 days ago for 40c and will be paid in 11 days. The company has increased its dividend for 49 years. Shouldnt you want a company that dont slash its dividends in bad times.

Source: pinterest.com

Source: pinterest.com

On May 7 2019 Leggett Platts board of directors declared a 040 quarterly dividend per share. Dividend went ex 23 days ago for 40c and will be paid in 11 days. Leggett Platt Announces Quarterly Dividend Of 40 First quarter dividend is 40 per share an increase of 53 versus 1Q 2019 First quarter dividend is 40 per share an increase of 53. Leggett Platt paid out a conservative 39 of its free cash flow as dividends last year. Less nice is the partly quite high payout ratio.

Source: 4percentportfolio.com

Source: 4percentportfolio.com

LEG didnt cut its dividend in 2009. During the COVID-19 crisis it almost looked as if Leggett Platt would not be able to pay the dividend. Wood sold 10346 shares of the businesss stock in a transaction dated Thursday February. The next Leggett Platt Inc. There are typically 4 dividends per year excluding specials and the dividend cover is approximately 16.

Source: seekingalpha.com

Source: seekingalpha.com

Leggett Platt is a diversified industrial company which has raised its dividend for 47 consecutive years making it a dividend aristocrat and poised to soon become a dividend king. Leggett Platts Board of Directors announced a dividend of 38 per share for the second quarter an increase of 02 per share or 56 versus the dividend declared in the second quarter of 2017. Leggetts dividends have increased each year for the last 48 consecutive years 1971 - 2019. With a 31 dividend yield Leggett Platt pays its shareholders a bit more than one-and-a-half times the market average. Shouldnt you want a company that dont slash its dividends in bad times.

Source: simplysafedividends.com

Source: simplysafedividends.com

The ex-dividend date of this dividend is Friday March 12th. The next Leggett Platt Inc. The company has increased its dividend for 49 years. Its positive to see that Leggett Platts dividend is covered by both profits and cash flow since this is generally a sign that the dividend is sustainable and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut. For context Leggett Platt currently pays a quarterly dividend of 038 per share for a payout ratio of 57 in the most recent quarter.

Source: valuewalk.com

Source: valuewalk.com

Using earnings Leggett Platts dividend appears very. The company qualifies for the Dividend Aristocrats Index as it has 47 years of consecutive dividend increases. Leggett Platt Announces Quarterly Dividend Of 40 First quarter dividend is 40 per share an increase of 53 versus 1Q 2019 First quarter dividend is 40 per share an increase of 53. Leggett Platt is a diversified industrial company which has raised its dividend for 47 consecutive years making it a dividend aristocrat and poised to soon become a dividend king. A stocks dividend reliability is determined by a healthy payout ratio that is higher than other stocks.

Source: nasdaq.com

Source: nasdaq.com

The company has increased its dividend for 49 years. The ex-dividend date of this dividend is Friday March 12th. For context Leggett Platt currently pays a quarterly dividend of 038 per share for a payout ratio of 57 in the most recent quarter. There are typically 4 dividends per year excluding specials and the dividend cover is approximately 16. During the COVID-19 crisis it almost looked as if Leggett Platt would not be able to pay the dividend.

Source: seekingalpha.com

Source: seekingalpha.com

For context Leggett Platt currently pays a quarterly dividend of 038 per share for a payout ratio of 57 in the most recent quarter. Leggett Platt Announces Quarterly Dividend Of 40 First quarter dividend is 40 per share an increase of 53 versus 1Q 2019 First quarter dividend is 40 per share an increase of 53. Leggett Platt was founded in 1883 and is headquartered in Carthage MO. Leggett Platts dividend payout ratio DPR is presently 6226. The ex-dividend date of this dividend is Friday March 12th.

Source: pinterest.com

Source: pinterest.com

Leggett Platt LEG will raise its quarterly dividend to 36 cents per share in 2018. This represents a 160 dividend on an annualized basis and a yield of 344. Dividend was 40c and it went ex 4 months ago and it was paid 3 months ago. Leggett Platts Board of Directors announced a dividend of 40 per share for the second quarter equal to the dividend declared in the second quarter of 2019. The next Leggett Platt Inc.

Source: simplysafedividends.com

Source: simplysafedividends.com

The next Leggett Platt Inc. Leggett Platts Board of Directors announced a dividend of 38 per share for the second quarter an increase of 02 per share or 56 versus the dividend declared in the second quarter of 2017. That is an impressive figure. The dividend is payable July 15 to shareholders of record by the close of business on. During the COVID-19 crisis it almost looked as if Leggett Platt would not be able to pay the dividend.

Source: pinterest.com

Source: pinterest.com

Leggett Platt has 14 business units and more than 22000 employees. Its positive to see that Leggett Platts dividend is covered by both profits and cash flow since this is generally a sign that the dividend is sustainable and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut. Shouldnt you want a company that dont slash its dividends in bad times. Leggett Platts Board of Directors announced a dividend of 40 per share for the second quarter equal to the dividend declared in the second quarter of 2019. Wood sold 10346 shares of the businesss stock in a transaction dated Thursday February.

Source: seekingalpha.com

Source: seekingalpha.com

Wood sold 10346 shares of the businesss stock in a transaction dated Thursday February. Leggett Platts Board of Directors announced a dividend of 38 per share for the second quarter an increase of 02 per share or 56 versus the dividend declared in the second quarter of 2017. Leggetts dividends have increased each year for the last 48 consecutive years 1971 - 2019. Leggett Platt LEG will raise its quarterly dividend to 36 cents per share in 2018. This represents a 160 dividend on an annualized basis and a yield of 344.

Source: nasdaq.com

Source: nasdaq.com

A stocks dividend reliability is determined by a healthy payout ratio that is higher than other stocks. Qualifying the company as a Dividend Aristocrat and Dividend Champion. With a 31 dividend yield Leggett Platt pays its shareholders a bit more than one-and-a-half times the market average. Dividend was 40c and it went ex 4 months ago and it was paid 3 months ago. Cutting your dividend in half to only double it means youre back to 2009 level.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title leggett and platt dividend cut by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.