Your Is leggett and platt dividend safe images are ready. Is leggett and platt dividend safe are a topic that is being searched for and liked by netizens today. You can Download the Is leggett and platt dividend safe files here. Get all royalty-free images.

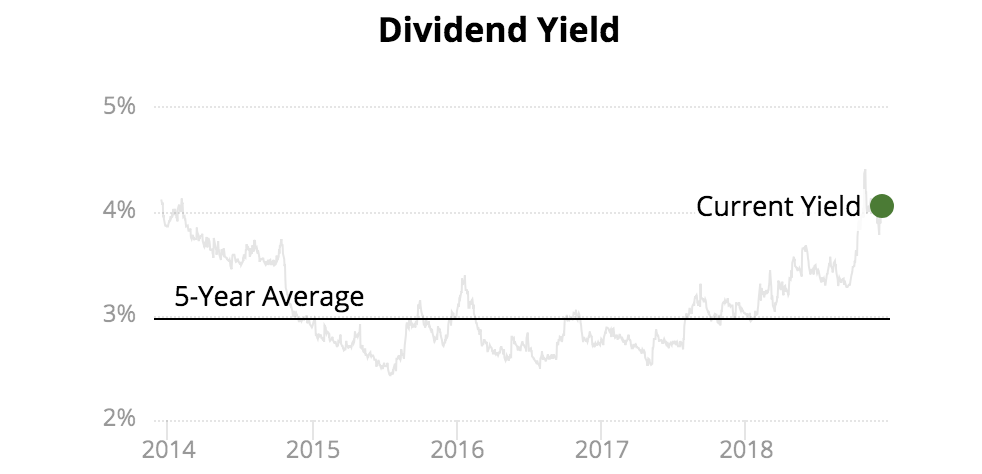

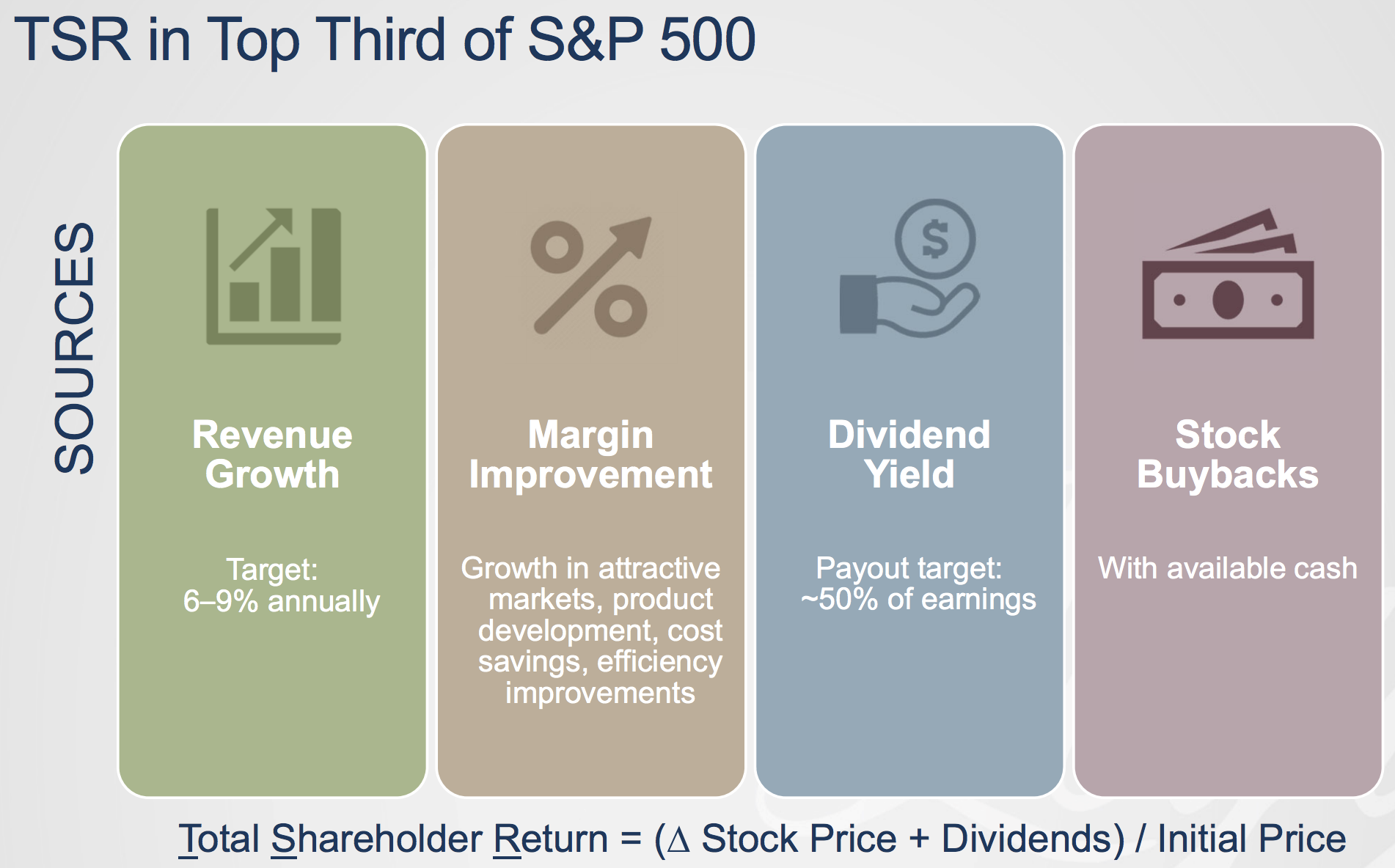

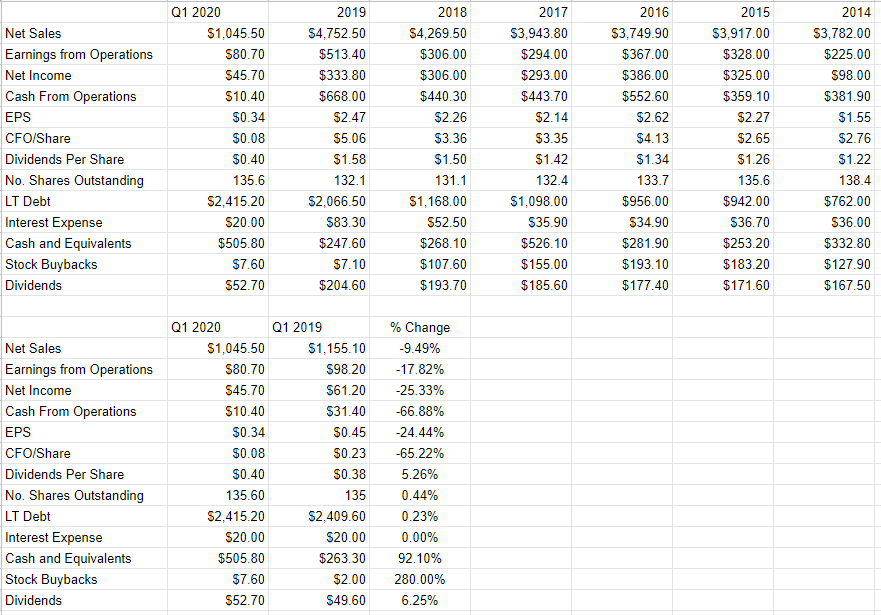

Is Leggett And Platt Dividend Safe. Leggett Platts dividends look absolutely safe with the ability to generate massive cash flows. The company has grown its dividend for the last 50 consecutive years and is increasing its dividend by an average of 406 each year. High dividend yields usually over 10 should be considered extremely risky while low dividend yields 1 or less are simply not very beneficial to long-term investors. Business Overview and Highlights.

Analyzing Leggett Platt S Big Acquisition Intelligent Income By Simply Safe Dividends From simplysafedividends.com

Analyzing Leggett Platt S Big Acquisition Intelligent Income By Simply Safe Dividends From simplysafedividends.com

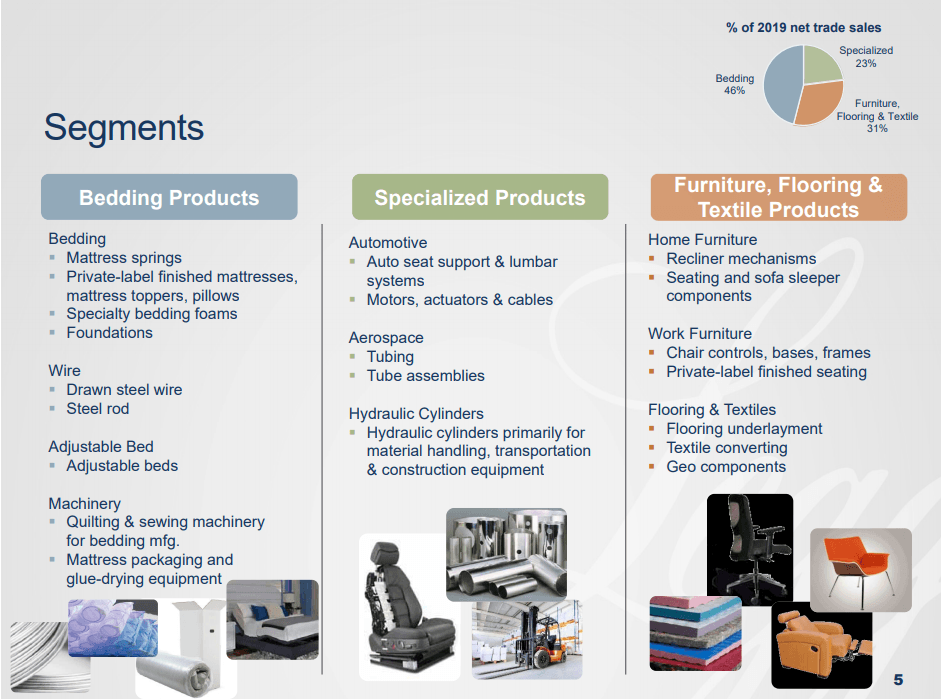

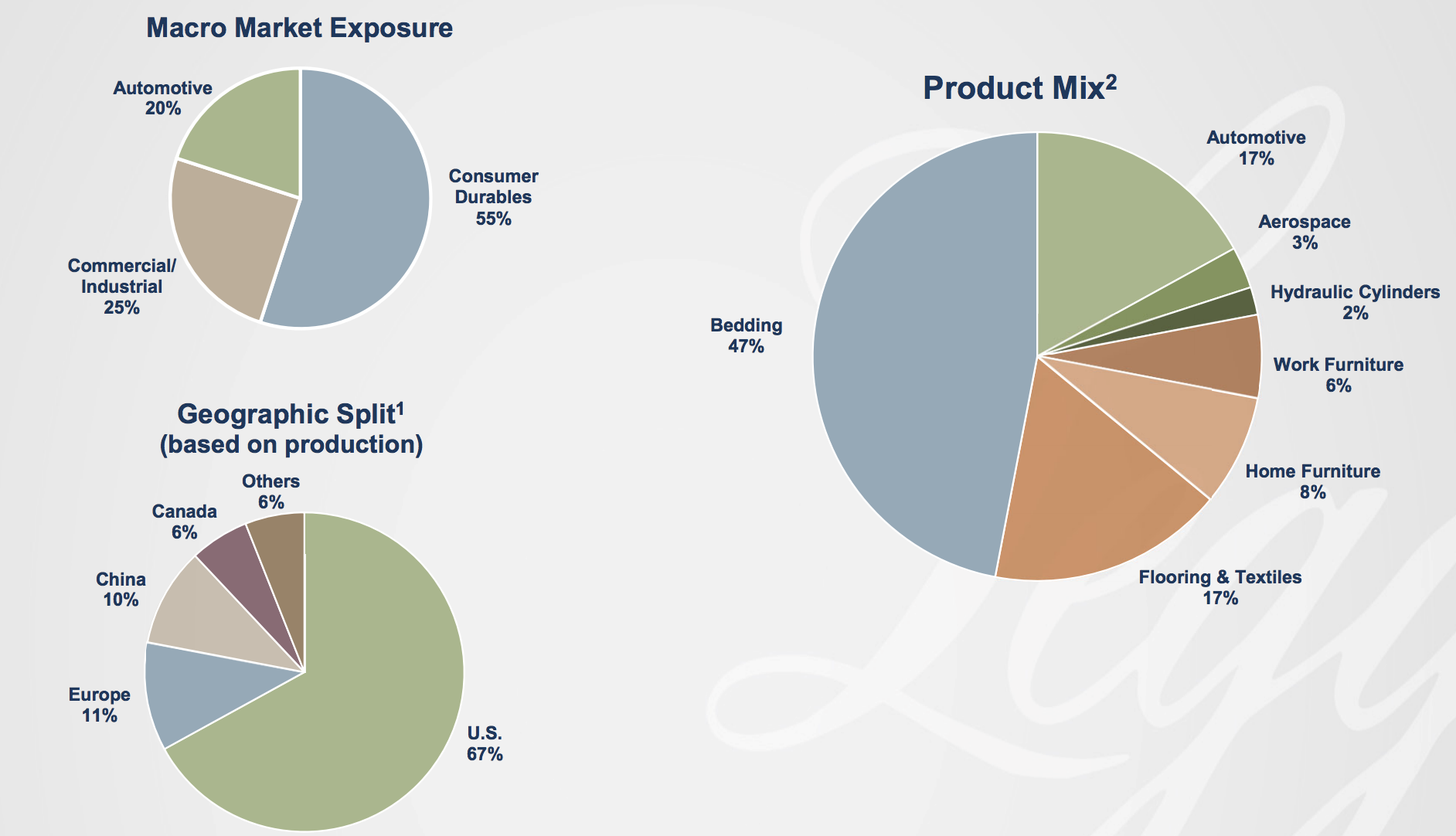

Leggett Platt does a good job of threading. Business Analysis Leggett Platts impressive dividend growth track is fueled by the firms long-standing customer relationships the company has been in the industry for over 100 years economies of scale the firm is also vertically integrated focus on innovation and global distribution system. LEG is far from a household name. Leggett Platt is a dividend aristocrat and has increased its dividend for 48 consecutive years. Dividend Reliability A stocks dividend reliability is determined by a healthy payout ratio that is higher than other stocks. Safe for dividend investors At this point Leggett Platt is doing all the right things and has a sustainable dividend.

Dividend Reliability A stocks dividend reliability is determined by a healthy payout ratio that is higher than other stocks.

Leggett Platts Dividend Safety Relative to Free Cash Flow. Safe for dividend investors. Leggett Platt. Business Analysis Leggett Platts impressive dividend growth track is fueled by the firms long-standing customer relationships the company has been in the industry for over 100 years economies of scale the firm is also vertically integrated focus on innovation and global distribution system. Many of the best stocks in the markets are companies that few have actually heard of. Leggett Platts dividends look absolutely safe with the ability to generate massive cash flows.

Source: pinterest.com

Source: pinterest.com

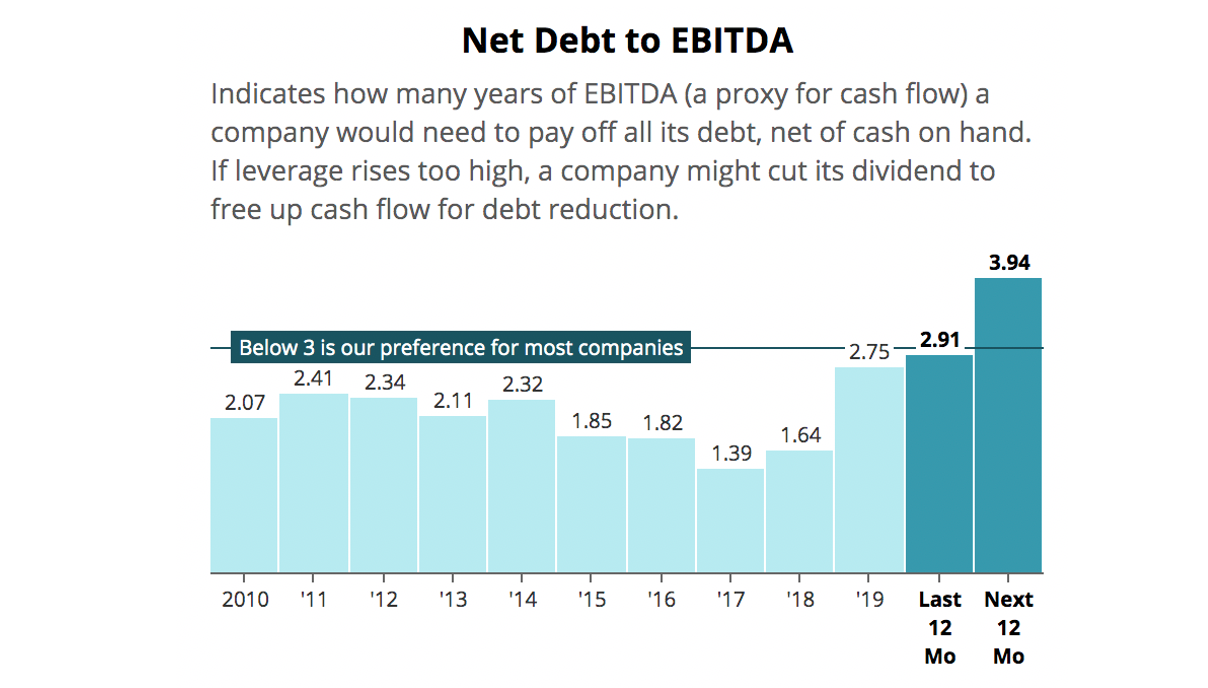

A return to a Safe rating is unlikely until the companys leverage is reduced and the pandemics longer-term impact on consumer spending becomes clearer. Safe for dividend investors. Is 124share currently paid in quarterly installments and its most recent dividend ex-date was on 12112014. At this point Leggett Platt is doing all the right things and has a sustainable dividend. Furthermore with the improvement of the economy Leggett Platt will generate much better results.

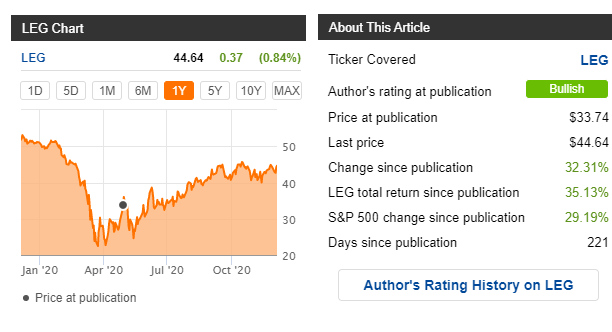

Source: seekingalpha.com

Source: seekingalpha.com

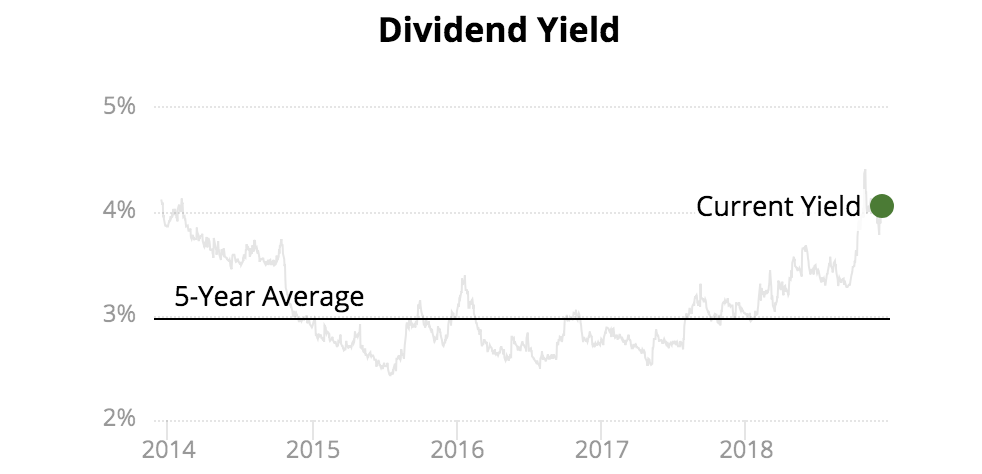

We possess one of the best dividend growth records among the SP 500. Leggett Platt is a dividend aristocrat and has increased its dividend for 48 consecutive years. Leggett Platt does a good job of threading the needle with its 3 yield coming in at about one. Leggett Platt pays an annual dividend of 160 per share with a dividend yield of 344. Using earnings Leggett Platts dividend appears very safe for the foreseeable future.

Source: dividendstocks.cash

Source: dividendstocks.cash

Business Overview and Highlights. LEGs next quarterly dividend payment will be made to shareholders of record on Thursday April 15. The right balance between a high yield and a sustainable yield is important for a dividend stock. Leggett Platt. Its positive to see that Leggett Platts dividend is covered by both profits and cash flow since this is generally a sign that the dividend is sustainable and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Source: simplysafedividends.com

Source: simplysafedividends.com

Many of the best stocks in the markets are companies that few have actually heard of. Safe for dividend investors. Business Overview and Highlights. LEG is far from a household name. The right balance between a high yield and a sustainable yield is important for a dividend stock.

Source: in.pinterest.com

Source: in.pinterest.com

The companys steady dividend growth in a sector known for its volatile sales and. Lets take a look at the business dividend history and payout safety going forward. Furthermore with the improvement of the economy Leggett Platt will generate much better results. Business Analysis Leggett Platts impressive dividend growth track is fueled by the firms long-standing customer relationships the company has been in the industry for over 100 years economies of scale the firm is also vertically integrated focus on innovation and global distribution system. Leggett Platt NYSE.

Source: seekingalpha.com

Source: seekingalpha.com

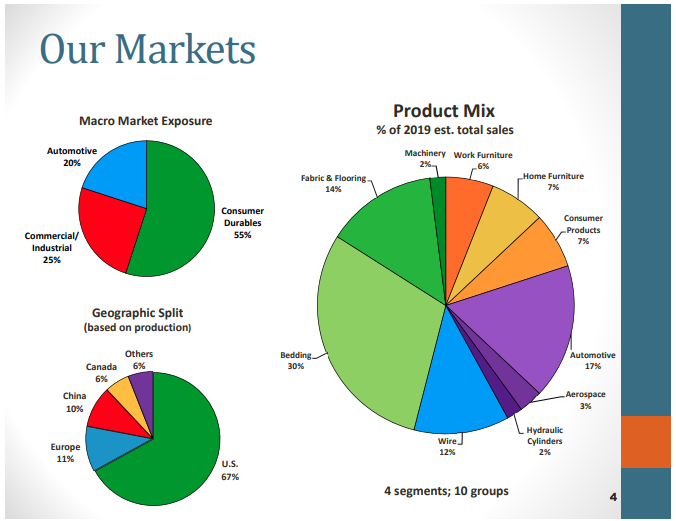

Leggett Platts dividend history is long and it might make a great addition to an income portfolio. A healthy dividend yield for Leggett Platt investors The right balance between a high yield and a sustainable yield is important for a dividend stock. The companys steady dividend growth in a sector known for its volatile sales and. Safe for dividend investors At this point Leggett Platt is doing all the right things and has a sustainable dividend. By end market 21 of Leggett Platts 2014 revenue was bedding 16 fabric carpet cushion 15 automotive 15 steel wire.

Source: seekingalpha.com

Source: seekingalpha.com

LEG is far from a household name. In this video we perform a deep dive on Leggett Platts dividend safetyLeggett Platt is a well-known dividend stock because of its compelling track rec. Dividend Reliability A stocks dividend reliability is determined by a healthy payout ratio that is higher than other stocks. Leggetts dividends have increased each year for the last 48 consecutive years 1971 - 2019. Leggett Platts Dividend Safety Relative to Free Cash Flow.

Source: simplysafedividends.com

Source: simplysafedividends.com

Leggett Platt pays an annual dividend of 160 per share with a dividend yield of 344. Using earnings Leggett Platts dividend appears very safe for the foreseeable future. At this point Leggett Platt is doing all the right things and has a sustainable dividend. Leggett Platt is a dividend aristocrat and has increased its dividend for 48 consecutive years. The company has grown its dividend for the last 50 consecutive years and is increasing its dividend by an average of 406 each year.

Source: seekingalpha.com

Source: seekingalpha.com

A return to a Safe rating is unlikely until the companys leverage is reduced and the pandemics longer-term impact on consumer spending becomes clearer. In light of these developments plus the companys ability to generate solid cash flow during downturns we are upgrading Leggett Platts Dividend Safety Score to Borderline Safe. Is 124share currently paid in quarterly installments and its most recent dividend ex-date was on 12112014. High dividend yields usually over 10 should be considered extremely risky while low dividend yields 1 or less are simply not very beneficial to long-term investors. Furthermore with the improvement of the economy Leggett Platt will generate much better results.

Source: pinterest.com

Source: pinterest.com

A return to a Safe rating is unlikely until the companys leverage is reduced and the pandemics longer-term impact on consumer spending becomes clearer. Its positive to see that Leggett Platts dividend is covered by both profits and cash flow since this is generally a sign that the dividend is sustainable and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut. Payment and record dates are the 15th or the last business day preceding the 15th if the 15th falls on a Saturday Sunday or Holiday. The annualized dividend paid by Leggett Platt Inc. Furthermore with the improvement of the economy Leggett Platt will generate much better results.

Source: stockopedia.com

Source: stockopedia.com

Leggett Platt does a good job of threading the needle with its 3 yield coming in at about one. LEGs next quarterly dividend payment will be made to shareholders of record on Thursday April 15. Leggett Platt pays an annual dividend of 160 per share with a dividend yield of 344. We possess one of the best dividend growth records among the SP 500. Leggett Platts dividend history is long and it might make a great addition to an income portfolio.

Source: simplysafedividends.com

Source: simplysafedividends.com

The company has grown its dividend for the last 50 consecutive years and is increasing its dividend by an average of 406 each year. Leggett Platt does a good job of threading the needle with its 3 yield coming in at about one. Leggett Platts Dividend Safety Relative to Free Cash Flow. LEGs next quarterly dividend payment will be made to shareholders of record on Thursday April 15. Leggett Platt.

Source: simplysafedividends.com

Source: simplysafedividends.com

Lets take a look at the business dividend history and payout safety going forward. Investors should expect another dividend increase in mid-2018 and as long as it can keep tapping into demand throughout the consumer and industrial sectors Leggett Platt has the capacity to remain a. Many of the best stocks in the markets are companies that few have actually heard of. Leggett Platts dividend history is long and it might make a great addition to an income portfolio. Is 124share currently paid in quarterly installments and its most recent dividend ex-date was on 12112014.

Source: seekingalpha.com

Source: seekingalpha.com

Many of the best stocks in the markets are companies that few have actually heard of. The right balance between a high yield and a sustainable yield is important for a dividend stock. A return to a Safe rating is unlikely until the companys leverage is reduced and the pandemics longer-term impact on consumer spending becomes clearer. Safe for dividend investors At this point Leggett Platt is doing all the right things and has a sustainable dividend. Leggetts dividends have increased each year for the last 48 consecutive years 1971 - 2019.

Source: forbes.com

Source: forbes.com

Leggetts dividends have increased each year for the last 48 consecutive years 1971 - 2019. In light of these developments plus the companys ability to generate solid cash flow during downturns we are upgrading Leggett Platts Dividend Safety Score to Borderline Safe. Business Overview and Highlights. Leggett Platt pays an annual dividend of 160 per share with a dividend yield of 344. LEGs next quarterly dividend payment will be made to shareholders of record on Thursday April 15.

Source: in.pinterest.com

Source: in.pinterest.com

Leggett Platt is a dividend aristocrat and has increased its dividend for 48 consecutive years. Leggett Platt does a good job of threading the needle with its 3 yield coming in at about one. The annualized dividend paid by Leggett Platt Inc. We possess one of the best dividend growth records among the SP 500. Payment and record dates are the 15th or the last business day preceding the 15th if the 15th falls on a Saturday Sunday or Holiday.

Source: simplysafedividends.com

Source: simplysafedividends.com

The company has grown its dividend for the last 50 consecutive years and is increasing its dividend by an average of 406 each year. The right balance between a high yield and a sustainable yield is important for a dividend stock. The companys steady dividend growth in a sector known for its volatile sales and. At this point Leggett Platt is doing all the right things and has a sustainable dividend. A healthy dividend yield for Leggett Platt investors The right balance between a high yield and a sustainable yield is important for a dividend stock.

Source: seekingalpha.com

Source: seekingalpha.com

Leggett Platt. A healthy dividend yield for Leggett Platt investors The right balance between a high yield and a sustainable yield is important for a dividend stock. Investors should expect another dividend increase in mid-2018 and as long as it can keep tapping into demand throughout the consumer and industrial sectors Leggett Platt has the capacity to remain a. The companys steady dividend growth in a sector known for its volatile sales and. Business Analysis Leggett Platts impressive dividend growth track is fueled by the firms long-standing customer relationships the company has been in the industry for over 100 years economies of scale the firm is also vertically integrated focus on innovation and global distribution system.

Source: seekingalpha.com

Source: seekingalpha.com

LEGs next quarterly dividend payment will be made to shareholders of record on Thursday April 15. We possess one of the best dividend growth records among the SP 500. Business Overview and Highlights. By end market 21 of Leggett Platts 2014 revenue was bedding 16 fabric carpet cushion 15 automotive 15 steel wire. Leggett Platts dividend history is long and it might make a great addition to an income portfolio.

Source: uk.pinterest.com

Source: uk.pinterest.com

Many of the best stocks in the markets are companies that few have actually heard of. At this point Leggett Platt is doing all the right things and has a sustainable dividend. In this video we perform a deep dive on Leggett Platts dividend safetyLeggett Platt is a well-known dividend stock because of its compelling track rec. We possess one of the best dividend growth records among the SP 500. A return to a Safe rating is unlikely until the companys leverage is reduced and the pandemics longer-term impact on consumer spending becomes clearer.

Source: pinterest.com

Source: pinterest.com

Dividend Reliability A stocks dividend reliability is determined by a healthy payout ratio that is higher than other stocks. In this video we perform a deep dive on Leggett Platts dividend safetyLeggett Platt is a well-known dividend stock because of its compelling track rec. Lets take a look at the business dividend history and payout safety going forward. At this point Leggett Platt is doing all the right things and has a sustainable dividend. Leggett Platt.

Source: seekingalpha.com

Source: seekingalpha.com

The annualized dividend paid by Leggett Platt Inc. Its positive to see that Leggett Platts dividend is covered by both profits and cash flow since this is generally a sign that the dividend is sustainable and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut. The right balance between a high yield and a sustainable yield is important for a dividend stock. Leggett Platts dividend history is long and it might make a great addition to an income portfolio. Leggett Platt pays an annual dividend of 160 per share with a dividend yield of 344.

Source: seekingalpha.com

Source: seekingalpha.com

Leggett Platt is a diversified industrial company which has raised its dividend for 47 consecutive years making it a dividend aristocrat and poised to soon become a dividend king. The right balance between a high yield and a sustainable yield is important for a dividend stock. LEG is far from a household name. At this point Leggett Platt is doing all the right things and has a sustainable dividend. A healthy dividend yield for Leggett Platt investors The right balance between a high yield and a sustainable yield is important for a dividend stock.

Source: seekingalpha.com

Source: seekingalpha.com

Furthermore with the improvement of the economy Leggett Platt will generate much better results. Leggett Platt does a good job of threading the needle with its 3 yield coming in at about one. A return to a Safe rating is unlikely until the companys leverage is reduced and the pandemics longer-term impact on consumer spending becomes clearer. We possess one of the best dividend growth records among the SP 500. High dividend yields usually over 10 should be considered extremely risky while low dividend yields 1 or less are simply not very beneficial to long-term investors.

Source: pinterest.com

Source: pinterest.com

Business Overview and Highlights. Leggetts dividends have increased each year for the last 48 consecutive years 1971 - 2019. Leggett Platt. High dividend yields usually over 10 should be considered extremely risky while low dividend yields 1 or less are simply not very beneficial to long-term investors. The right balance between a high yield and a sustainable yield is important for a dividend stock.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title is leggett and platt dividend safe by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.